I started a software business that ended up being a logistics business that actually ended up being a finance business.

Here's a little story about what that even means, how it happens and what you can learn form it to help you build your own thing faster.

I grew up on a dairy farm.

Grow crops. Feed Cows. Milk cows. Sell Milk.

Those first 3 activities are simple but very labor intensive so I had lots of time to think while doing them.

I was always dreaming up ways to improve what we where doing with technology.

I decided to start a software business to help make managing the process of feeding cows easier.

I built an app.

It helped manage the inventory and mixing to feed thousands of cows every day reliably, simply and efficiently.

You just needed a phone.

In hindsight it would have probably been wise to just charge money and work on selling this more but I was ambitious, wanted to build a huge business, and wanted the app to have a free tier.

"Farmers don't like buying software they like buying inputs" was ringing in my ear.

I figured I wouldn't become a billionaire selling SaaS to small farms so we decided to start a marketplace.

I had a cofounder by this point and we both agreed a marketplace is about one of the best businesses you can own.

Farms spent a bunch of time and effort figuring out what feed to buy and from who because it mattered a lot to them so the problem was real.

60% of a farms costs could be attributed to feed.

So there was good reasons to try and tackle this problem and it could be giant although we definitely did it out of ambition rather than a customer pulling us to solve the problem.

So the first product we had was very much just software.

The best marketplaces also are.

It turned out that wasn't going to be our experience we just did not fully understand that yet.

We needed a way to kickstart the marketplace.

The infamous "cold start" problem.

We where helping farmers buy large bulk goods that came by the ton in a semi truck possibly from a vendor in different state.

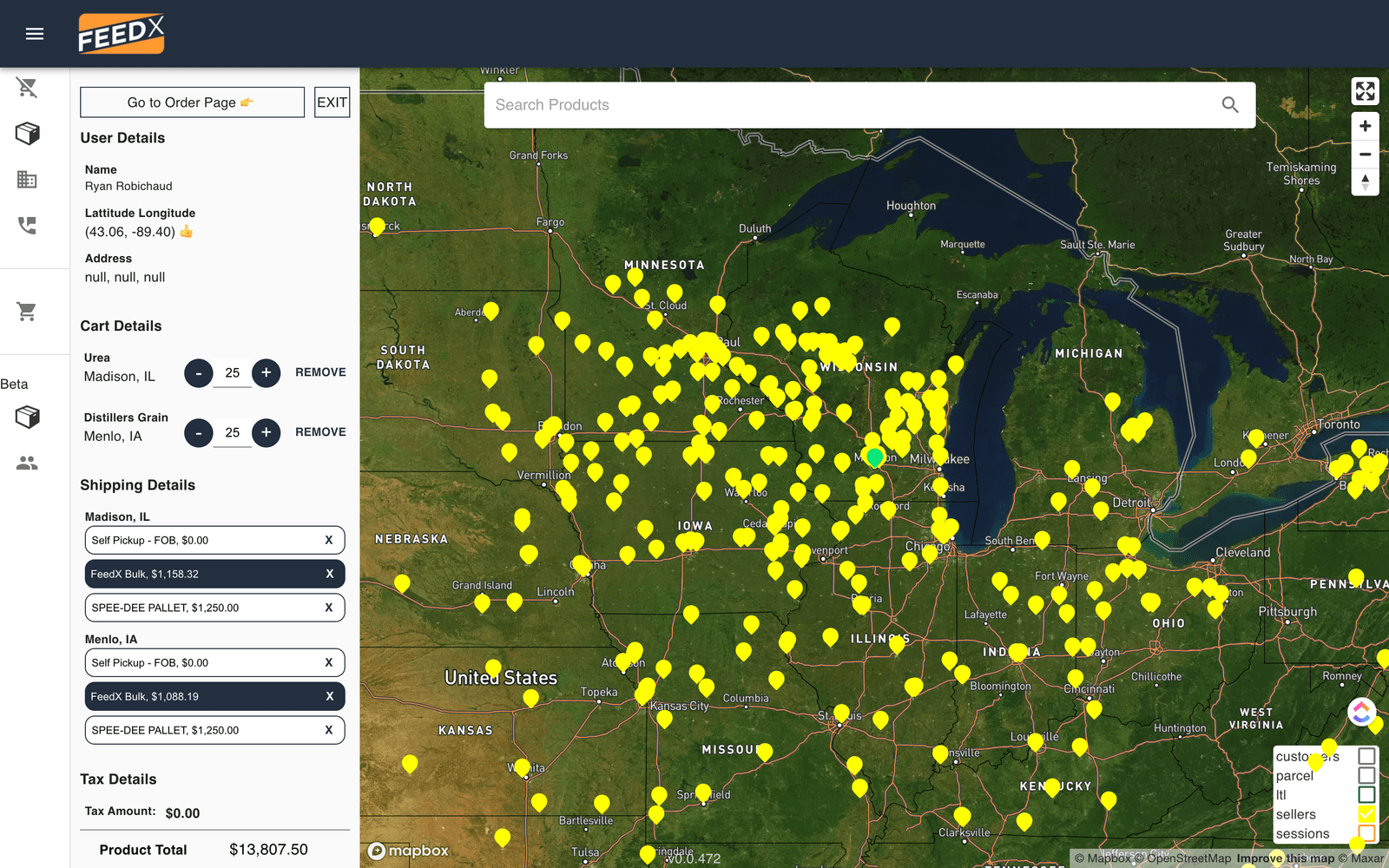

Trying to make this happen almost immediately turned the businesses main activities into talking to trucking companies, managing trucks, dealing with "bills of lading" etc.

We still wrote software, way too much in fact, but we mostly just had to build a process around, and relationships with trucking and logistics companies that could make any of this possible.

Software Company -> Logistics Company

We stopped working on the software for feeding cattle and only focused on software that would help the marketplace be a success.

We even ended up doing a bit physical warehousing and trucking ourselves because we could make a buck here or there and we where bootstrapped and needed every penny.

You can see this change in focus most obviously in next iteration of our marketplace software that essentially only focused on solving for logistics problems.

If we could not solve our logistics problems we definitely where not going to grow to be a big thing.

We worked hard and got the logistics to work. It was never pretty but we got to the point where we had helped sell feed in all lower 48 states and had done something like $1m Gross Marketplace Volume.

My cofounder lived on the phone with trucking companies or in a truck himself and we hired some help to do office work. Our paper work was a mess but we where growing even if slowly.

Up until this point we had been completely bootstrapped. We also where super boring to any VC's we ever talked to. It was not an exciting business or at least we did not know how to sell that it was to anyone with money to invest.

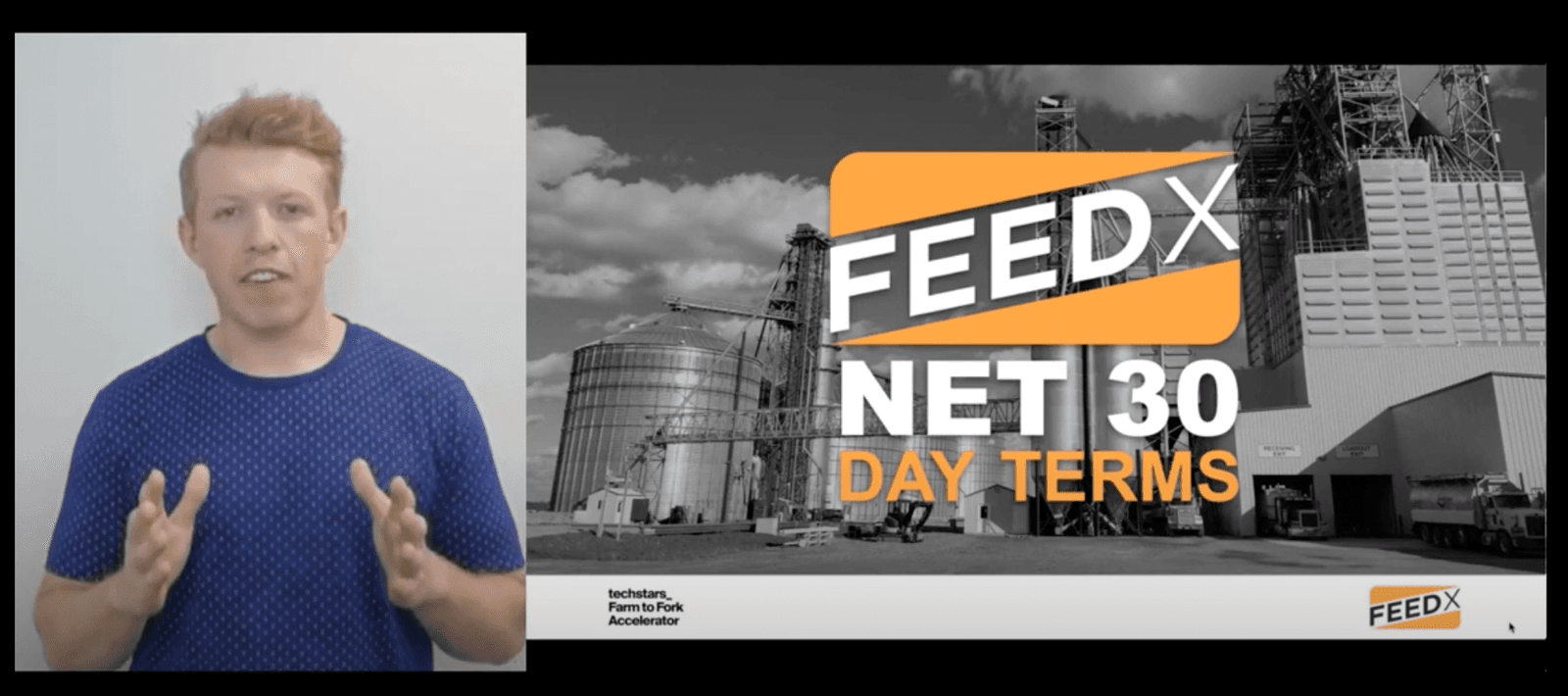

But, through some luck, sheer force of will, and our business metrics to prove it, we got into Techstars Farm To Fork Accelerator.

Now we had a tiny bit of cash from the accelerator investment.

We had some handle on our logistics problems at least enough to keep growing.

But things where not all going the direction we wanted.

Our sellers, and ourselves in some cases, where taking on more risk than was sustainable in the transactions.

We literally where accumulating risk.

Feed is basically always sold on Net 30 Day terms. Aka you pay the seller 30 days after the product is delivered.

Historically feed vendors where skeptical to sell to new people because of no clear way to solve the risk involved.

Essentially sellers took a lot of losses on selling feed and not getting paid. This was just part of this business. So they usually just did business with mostly the same people forever.

We had made it this far by doing some guaranteeing ourselves, being ok salesmen, and selling some higher value and obscure items that we could convince people to pay upfront for vs Net 30.

This however seemed to be a problem we could not avoid forever. We definitely would not become a big thing if we could not solve it.

At the same time we also had a chance to talk to the biggest feed company in the USA while in Techstars which helped us see our problems more clearly.

Cargill, the largest privately owned business in the Unites States with valuation estimates around $80B in 2024, was a corporate partner with Techstars and as part of the accelerator we got to talk to a lot of important people we could not normally reach.

I can remember the moment exactly.

We are on a zoom call during covid with this Cargill executive and he stops us in the middle of a sentence.

"Guys guys, ok, you didn't hear this from me alright, but you have to stop thinking of Cargill as a feed company. You have to start thinking of it like a bank."

Transformation complete.

Software Company -> Logistics Company -> Finance Company

We knew he was right, it solidified all the feelings related to Net 30 terms and risk we had been fighting the whole time we had been building the marketplace.

Big feed companies used the heft of their balance sheet to act like a bank for their customers.

I called it the "Gray Market for Capital" because it was so big, opaque, and engrained in the entire supply chain.

We didn't have a big balance sheet so we needed another option.

We used all our money and time to incorporate an embedded fintech solution that let us evaluate a farmers credit and guarantee a certain spend level on the marketplace. Officially getting our sellers out of the Net 30 Day Terms game and making it risk free for them to sell to farms they did not know.

The fintech partner would pay the feed vendor on day 1, the farmer would pay the fintech partner on day 30, the partner earned some interest along with other fee's paid by us.

At the same time we needed to make sure our normal operations of moving feed all over the country kept growing or it would be impossible to fundraise.

But guess what.

The finance plan did not work.

Our sales dropped because our focus was on something else.

We had discovered our next wall and what the large feed business truly was but did not find a way to climb it with what we had.

We decided to pivot and get out of feed entirely.

Now there are a tons of lessons to be learned in this story I won't get into here.

The only one I'm worried about today is finding out what business you are really in and figuring it out as fast as possible.

Alex Hormozi made a great video about this recently.

He figured out a faster way to figure this out then I ever have.

To know what business you are really in you just need to look at what business your trying to be like and see what they care about.

From his example.

If your trying to be a giant fitness business look at other giant fitness businesses and see what they care about. If the workouts are bad it probably means the workouts don't really matter and what the business really "is" is something else.

In his case it was sales and marketing.

Now.. it's not possible to know all these things in advance but you can do way better then I did.

The faster you truly know what business you're in the faster you can make it a truly great business.

Everything you have every heard about being fast and optimizing for learning are all at least partially true because they help you know this faster.

If you wanted a software business and it turns out the business is something else just go build a different business that is software.

If you are obsessed with solving a problem and it doesn't matter how, do everything possible to learn what your business truly is as fast as possible.

Good luck.